Real estate isn’t just about owning physical lands today. It’s also about buying digital properties in the metaverse. What is it? Learn more below.

Metaverse has been a hot word in the online community recently, but its popularity only ever increased when Facebook’s parent company launched its new name, Meta. The goal is to focus on virtual reality and allow people to bring their offline activities to the online realm. The metaverse is an interactive 3D world where you can own and monetize your assets. For many, it’s where the future economy is heading.

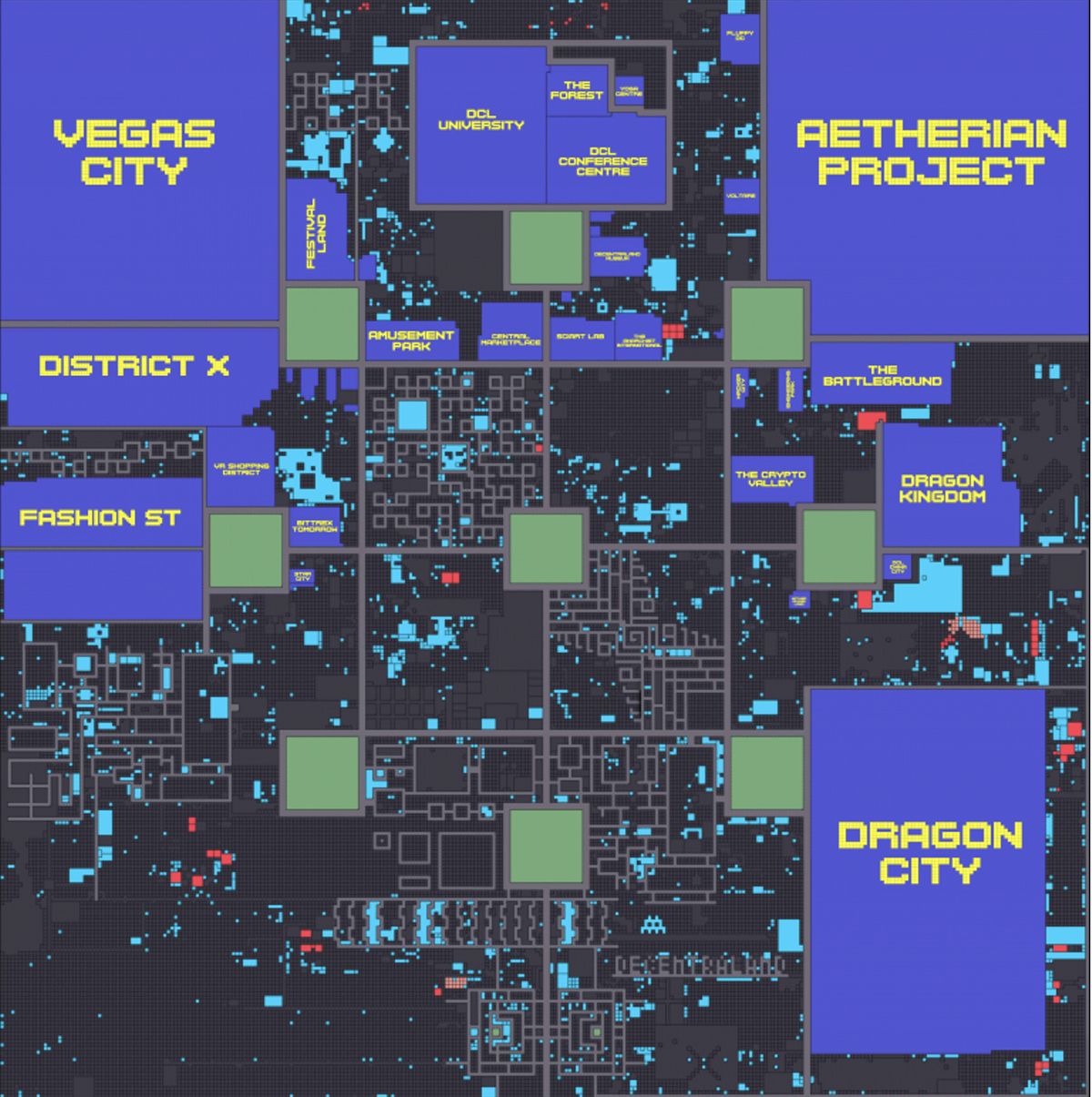

It has all the elements that one could want. The Sandbox and Decentraland are the biggest metaverse platforms today and they created a level of exclusivity as they announced their lack of plans of creating more plots of land in their digital world.

Investing in virtual property

Investing in virtual property is no longer a preposterous idea. Predictions point to digital real estate as the next best investment for the future. In November, Barbados announced its plan of opening a virtual embassy in Decentraland. Days after the announcement, Decentraland sold a digital plot for $2.4 million. This week, its rival company, The Sandbox, also sold the highest digital land as of yet for $4.3 million. Altogether, all the biggest metaverse platforms sold over $100 million in just the past week. Digital real estate is booming and this rapidly growing interest has the potential of generating $1 trillion revenue in a year. From buying and selling or renting your virtual lands, the metaverse real estate could be a gold mine for real estate investors.

The “ FOMO” rises as real estate investors seeking better yield.

Investors are now rushing out to the metaverse making their stakes in the virtual world, ensuring that they’re not missing out on the digital real estate space. Tycoons in the real estate industry are also checking out this new platform. Adrian Cheng, CEO of Hong Kong’s New World Development said that he’s investing and out to buy the largest plot in The Sandbox metaverse. The plan is to create an innovation hub, a virtual economic zone that will show the growth of startup businesses.

There are still considerations before you do the same and invest in digital real estate. In an interview with the Wall Street Journal, Zach Aarons (general partner of Meta Prop, a real estate tech VR firm) said that while it’s a rapidly growing space, it’s still very volatile and high-risk. But there’s no stopping individuals and companies that focus on the possible trillion-dollar business that this metaverse will generate in the future.

Could Metaverse be the future of real estate?

Like any other industry, the real estate industry has also seen so many changes in trends over time. From the creation of Metaverse that pushed real estate agents and investors to embrace the virtual world to the pandemic that caused ripples in the real estate market. Everyone involved in real estate had to adjust to the changes. However, these shifts aren’t stopping and there will be more for real estate moving forward. Let’s mention some of them.

Since February this year, every piece of virtual land amounted to $1.5 million in real-world money. The investor took to Twitter and tweeted that there’s a rise of digital nations with their own systems. It’s a historic event not only for the virtual world but also for real estate. With virtual lands offering all the elements one would see in real life, from entertainment to social, and economic value.

Today, real estate agents are already in the metaverse space and are participating in digital selling. Metaverse Real Estateis the first virtual real estate firm in the digital world. It was created by Michael Gord and Jason Cassidy, both Canadian cryptocurrency entrepreneurs. The metaverse is the land rush that everyone is talking about.

There’s certainly a good level of interest there. Even big retail brands are already putting up virtual stores and selling virtual products in the Metaverse. Forever 21 recently bought a space in the Roblox gaming platform and built the Forever 21 Shop City. Still, it’s unsure whether people will be able to access any of these digital stores and enjoy metaverse in the coming months and years.

Multifamily investments VS Metaverse

Multifamily is another real estate trend that continues to flood the market. The return on investment is high and it’s only going to increase next year. Government regulations are also improving for multifamily real estate. New policies are coming up in high-demand locations such as in New York City, Georgia, and Florida. Agents and investors expect to see more states welcome multifamily in their areas. Unlike the Metaverse, multifamily offers more stability and has better yield for investors in 2022.

Supply and demand play a huge role in the success or downfall of real estate, both in the digital and real world. With increasing demand and supply, Metaverse real estate may survive. Do you want to learn more about real estate investment both online and offline? Don’t hesitate to drop us a message.

We Write about #LessBoring Real estate Investments

Ike Bams & John Williams are upcoming real estate developers in Dallas Tx who aim to convert vacant office buildings into apartment units nationwide. Subscribe to get full access to the newsletter, development tips, investment analysis, passive income ideas, adaptive reuse strategies, deal flow, interior design and other out of the box thinking about real estate investments.

Click Here to Join our investors distribution list and create passive income with above average ROI.